GST Registration in India

A.ADVANTAGES OF GST REGISTRATION

- Legal status as per GST act.

- Legally authorized to collect output tax from customers

- He can claim input tax from Govt:

Table of Contents

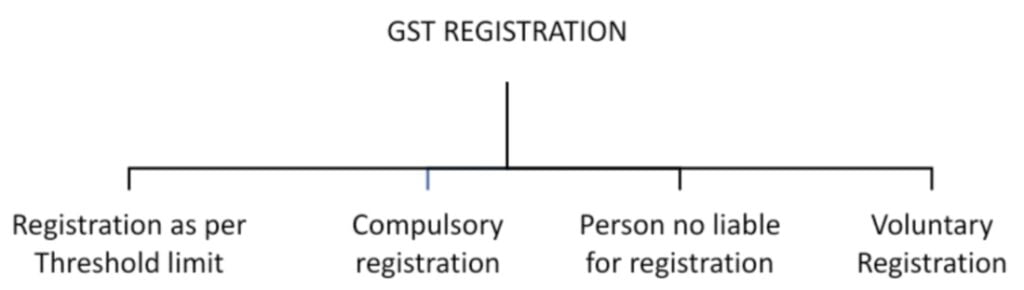

B.PERSON-REGISTRATION IN GST

- As per Threshold limit [ANNUAL SALES]

| State: 10Lakh for Goods and Services. | States: 20 Lakh for Goods and Services. | States:40 Lakh for Goods, 20 Lakh for Services. |

| Manipur, Mizoram, Nagaland, Tripura | Arunachal Pradesh, Meghalaya, Sikkim, Uttarakhand, Puducherry, Telangana | Jammu Kashmir Assam Himachal Pradesh All other states |

- Compulsory Registration:-

- Persons Making Any Interstate Taxable Supply.

- Casual Taxable Person [CTP] Making taxable Supply.

- Non-Resident Taxable Person [NRTP] Making Taxable Supply.

- Person Who are Required to Pay Tax under Reverse Charges.

- Input Service Distributers Whether or not separately registered under this act.

- Person who are required to deduct TDS under section 51,Whether or not separately registered under this act.

- Every-Commerce Operator who is Required to Collect TCS Under Section 52.

C. Person No Liable to Take Registration:-

- Supply of Exempted goods

- Agriculturist

- Voluntary Registration.

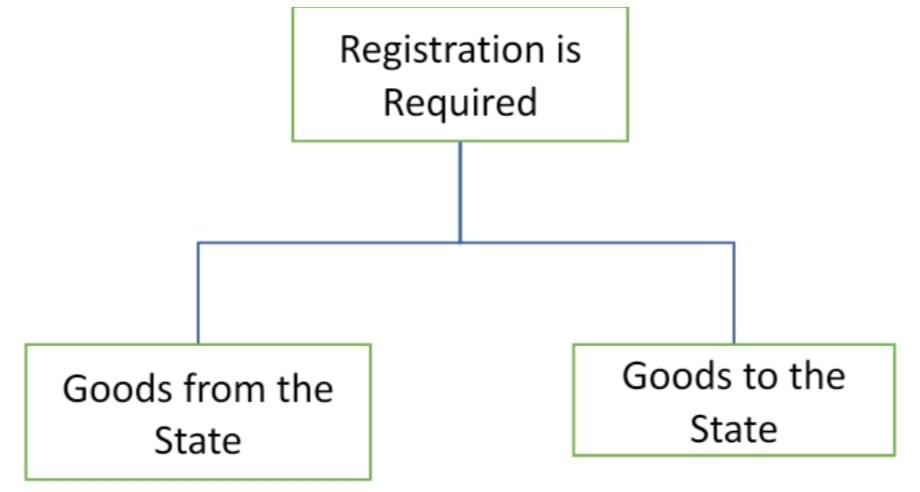

C.REGISTRATION STATE

Note: You Must Take Registration from the State that you supply goods from the state.

WHEN LIABILE FOR GST REGISTRATION

30 days after exceeding Threshold Limit.

Fee for take GST registration

There is no Registration Charge/Fee for getting GST Registration

D.MATERIAL REQUIRED FOR APPLYING GST REGISTRATION: –

1.PAN Card

2.Rent Agreement 3.Passport Size Photo.