[dcafa]

Diploma in computer application & financial accounting

For Girls Only

Students Get Global Certification

Placement Assistance

life time membership

quality practical training

Course Overview

this course is specially designed for girls students.

it covers finance accounting with GST and Gulf VAT and also office administration program.

Course curricullam

| COURSE LESSONS |

|---|

| Basics Of Accounting & Book keeping |

| Manual Accounting |

| TDS / INCOME TAX |

| GST (India) |

| GCC VAT |

| E-Filing |

| E-Way Bill System |

| Basics Of Computer |

| Tally.ERP9 & Tally Prime |

| Microsoft Excel |

| GST Experiential Learning |

| Tally Billing System |

| Microsoft Word |

| Project Presentation |

| Internet Application |

| Ageing & Dunning |

| Business Letter |

| Banking Letter |

| Resume & Cover Letter |

theory part

- business and banking documents

- theory of business accounting

- preparation of accounts book

- theory of income tax and TDS

- theory of advanced accounting

- preparation of financial statements

- bank reconciliation

- advanced journal entries

- theory of payrolls

- process of logistics management

- interview questions

- GST return form

- GSTR-1

- GSTR-2

- GSTR-2A

- GSTR-3B

- what is an e-way bill

- when to generate an e-way bill

- who should generate an e-way bill

- cases e-way bill is not required

- how to generate an e-way bill

- the validity of the e-way bill

- documents for e-way bill

- how to cancel the e-way bill

- GST levy

- time of supply

- place of supply

- transitional problem

- registration

- input tax credit

- valuation

practical part

tally prime and ERP 9

- company creation

- accounts masters with GST

- inventory masters with GST

- process of logistics management

- transaction with GST

- GST calculation and exporting the file

- fixed assets management

- bank reconciliation in tally

- bill of material for the production

- job costing, job work analysis

- pricing ETC…

- VAT set up for a company

- ledger creation with VAT

- inventory creation with VAT

- transaction with VAT

- VAT calculation and adjustment entry

- classification of cost elements

- creation of location

- job costing

- job work analysis

- calculation of work-in-progress

- calculation of contract income

- contract income adjustment entries

- payroll master setup

- employees earnings and deduction

- employees attendance and overtime

- employees salary autofill

- employees PF and ESI

- payroll reports

- salary adjustment

- TDS activation

- ledgers creation with TDS

- TDS for providing service

- TDS deduction by customers

- payment of TDS

- ITNS 281, ITNS 282 & return form

Microsoft Excel(2016-2019)

- creating and managing a workbook

- managing worksheet

- customize column & row

- define named cell

- entering and modifying data

- cell formating

- conditional formating

- creating basic formula

- applying basic function

- sort and filter

- creating excel table

- pivot table reporting

- advanced conditional formating

- slicer filtering of data

- multilevel sorting

- creating advanced formula

- find and replace data

- applying advanced functions

- importing data from other source

- convert text to column

- remove duplicate data

- data validation

- list settings

- excel chart/pivot chart

- goal seak

- subtotal option

- subtotal functions

- page layout and print settings

- mathematical functions

- statistical functions

- logical functions

- financial functions

- lookup functions

- text/date and time functions

- nested functions

- accounts and inventory registers

- final reports preparation

- payroll reports

- loan amortization table creation

- sales dashboard…..

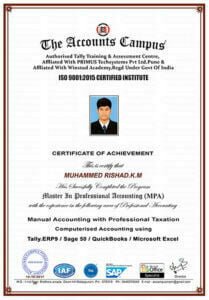

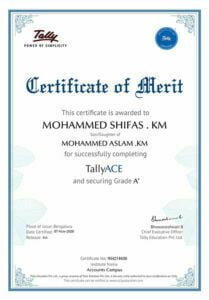

Exam & Certifications

- Manual Accounting Exam

- Tally Practical Exam

- Microsoft Excel online Exam

- ISO Course Certificate

- Tally Project Certificate

- Microsoft Excel Project Certificate

- Tally Authorised Certificate (Govt)

- Microsoft Authorised Certificate

- GST Centre Certificate

EXPLORE YOUR CARRIER

specialized programs

- GST Online Registration

- GST E-way Bill for Company

- GST Payment for Company

- GST E-Filling For Company

- Barcode Billing

- Multiple GST Invoice

- 22 Realtime Works

- 2 Project Work

- duration - 5 months

- Central Govt certification

- ISO 2009-2015 course certificate

we provide global certification

if you want more about the course details feel free to contact phone +91 9744380143, +91 9446074949

GET IN TOUCH

satisfied students

I graduated and took an accounting course from an accounts campus excellent teachers are a key component of that institution I have been referred to a lot of my friends since I finished my studies thanks to this institution for being able to study manual accounting and tally, excel well and efficiently

I Am Perfectly Completed ... Good Teaching.....So Thank You .......

Nice Campus With Extra Ordinary Faculties

Good Coaching ,Better Atmosphere And Classes

Best Training And Practice In Accounting....

Excellent Teachers,Good Computer Labs,Good Infrastructure Facility.....

Accounts Campus is a Fabulous Masters Of Accounts.i Really enjoy the journey through out of my class.Experienced Teachers for teaching.

Good Teaching And Helpful Of Studies Behave To Friendly

It's a great honor to be a Part of Accounts Campus. For your Professional development, Accounts Campus is one of the best Accounting Institute in Malappuram with strong instructions and clear objectives. Well experienced Teachers provides opportunity to reshape our performance to achieve better goals. I recommend Accounts Campus for your Accounting Career

ഡിഗ്രി കഴിഞ്ഞതിനു ശേഷം ഒരു അക്കൗണ്ടിങ് കോഴ്സ് ചെയ്യണം എന്ന് വിചാരിച്ചു നിക്കുമ്പോഴാണ് അക്കൗണ്ട് ക്യാമ്പസ് നെ കുറിച്ച് അറിഞ്ഞത്.6 മാസത്തെ കോഴ്സ് ന് ആണ് ചേർന്നത്. അക്കൗണ്ടിങ് ന്റെ താഴെ തട്ടിൽ നിന്നാണ് ക്ലാസ്സ് സ്റ്റാർട്ട് ചെയ്യുക ഡൌട്ട്സ് ഉണ്ടെങ്കിൽ അതു ക്ലിയർ ചെയ്യാൻ എത്ര തവണ വേണമെങ്കിലും പറഞ്ഞു തരും. നമ്മുടെ സമയത്തിന് അനുസരിച്ചു ക്ലാസ്സ് ഫിക്സ് ചെയ്യാം. ചെയ്യാൻ തരുന്ന വർക്കുകളും നിലവിൽ ഉള്ള കമ്പനികളുടെ ആണ്. കോഴ്സ് കഴിഞ്ഞ് ഒരു ആഴച്ചക്കുള്ളിൽ ഒരു ഇന്റർവ്യൂ ന് അവസരം ലഭിച്ചു.2.5 കൊല്ലമായി അവിടെ വർക്ക് ചെയുന്നു. എന്ത് സംശയം ഉണ്ടങ്കിലും അവരെ ആണ് ഫസ്റ്റ് വിളിക്കുക. കോഴ്സ് കഴിഞ്ഞിട്ടും കോൺടാക്ട് നിലനിർത്തുന്നു..